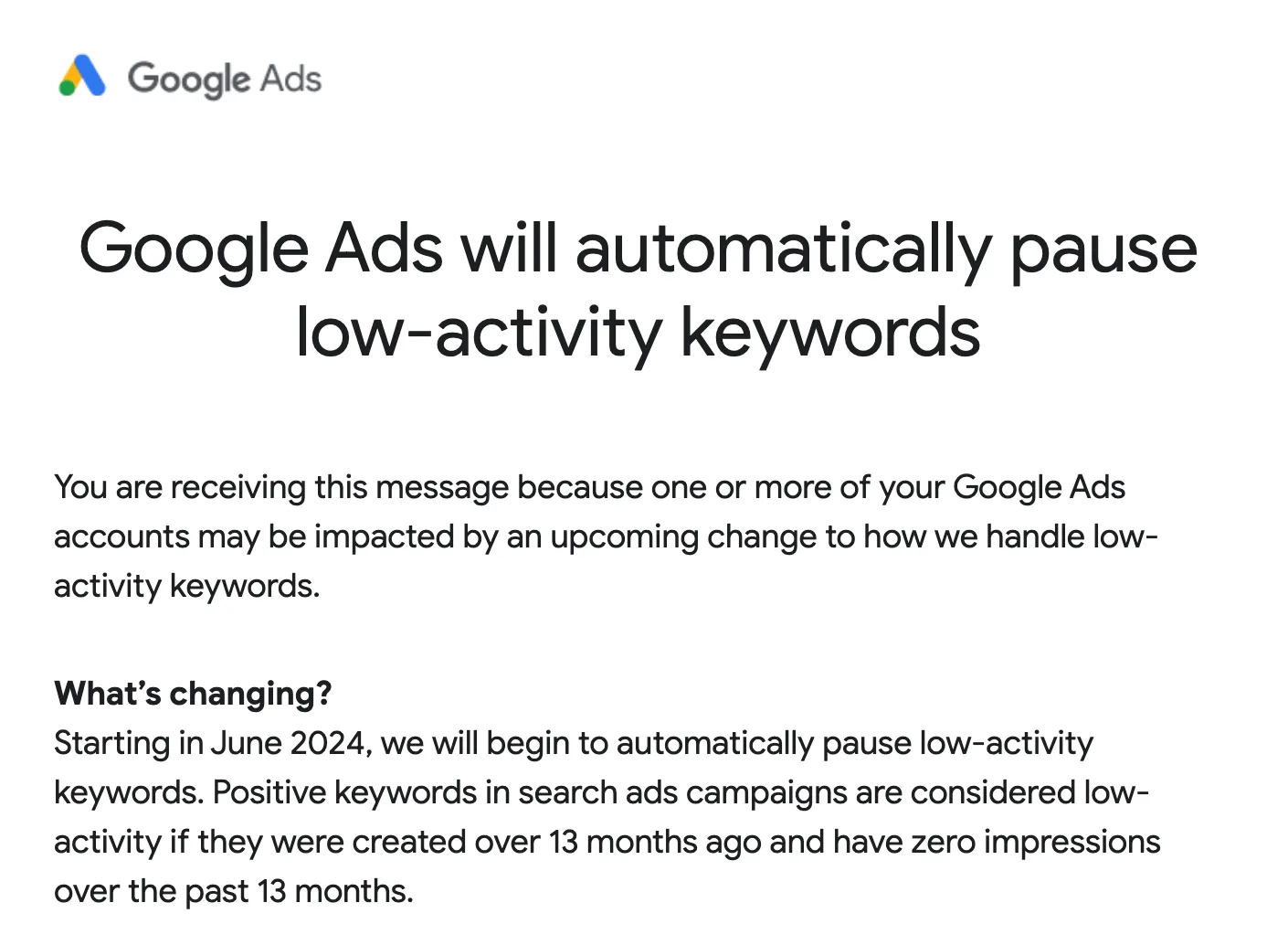

When Google announced they would begin pausing low-activity entities (first ad groups, then keywords), the news was met with mixed response. Some felt it was an overreach and that practitioners should decide if keywords should be paused. Others felt that if an entity hadn’t done anything in 13 months (the minimum timeframe for it to be eligible for auto-pausing), it was time to move on.

There are a few theories around paused entities that are worth digging into before we dive into the data to help unpack the tension. While there is no official documentation supporting these theories, we respect that marketers have experienced anecdotal data to support them:

- Some advertisers believe that leaving keywords with no performance in accounts helps other keywords do better. This is not supported by official documentation. Google actually says the opposite: that you might be creating duplicates.

- There are other advertisers who have seen keywords go for months without any traction, and then all of a sudden pick up. Advertisers who have seen this happen, and voice frustration that their keywords no longer get unlimited ramp up time are sharing valid fears and frustrations. We haven’t seen this in a significant way, but that doesn’t diminish that some brands may experience this.

We do not hold any firm opinions on what the data would hold, however we do want to investigate the following questions:

- How many marketers will be impacted and to what degree (number of keywords, performance, etc.)?

- What kind of accounts do most marketers run today, and does the mass pausing represent a shift for most marketers account management styles?

- Is there risk associated with Google’s mass pausing of keywords?

This is part one of our two part study. The second part will come out towards the end of the summer when we check in on the accounts in this study.

A bit about the criteria:

- Accounts had to have at least 13 months of performance.

- Accounts were split into three categories: Small (400 or fewer keywords), Medium (400-3000 keywords), and Large (3000+) keywords.

- Accounts were further split into percentage of zero-volume keywords (0-25%, 26-50%, 51-75%, 76%+)

- 9430 accounts are included in our study

- We included accounts from all markets

Because we did not bake in any consideration for the type of account (e-commerce/lead generation, Performance Max, age of account), we are not sharing the specific metrics associated with each group. That said, we looked at CPA, ROAS, CTR, CPC, and conversion rates to get some of those directional cues on performance.

The Data

How Many Accounts Have Significant Amounts (50%+) Of Low Volume Keywords:

Total: 7888 (84% of accounts)

Small: 3,020 (38%) accounts of the 4,300 small accounts.

Medium: 3378 (43%) accounts of the 3623 medium accounts

Large: 1490 (19%) accounts of the 1507 accounts

We compared the performance of accounts with a high percentage of low volume keywords with accounts with a low percentage of low volume keywords.

We found no meaningful difference in performance, which is why we believe most of these accounts won’t be negatively impacted. This is especially true given that the 378 accounts with 0-25% have some of the best performance of any account type (all metrics save for ROAS). When the change happens, accounts will likely mirror this account type (going from large to medium/small or medium to small).

There are a few outliers (145 accounts with very strong performance) in the large account category that may see a decrease in performance, due to how many keywords would get paused. Given that they were in the 50-75% tier, the pausing will represent a major shift.

For transparency sake, here’s the breakdown of how many accounts fell into each category:

Number of KWs | Category | No. of Accounts |

Low | 0-25% 0-impression kw | 378 |

Low | 26-50% 0-impression kw | 902 |

Low | 51-75% 0-impression kw | 1341 |

Low | 75-100% 0-impression kw | 1679 |

Medium | 0-25% 0-impression kw | 39 |

Medium | 26-50% 0-impression kw | 206 |

Medium | 51-75% 0-impression kw | 868 |

Medium | 75-100% 0-impression kw | 2510 |

High | 0-25% 0-impression kw | 2 |

High | 26-50% 0-impression kw | 15 |

High | 51-75% 0-impression kw | 145 |

High | 75-100% 0-impression kw | 1345 |

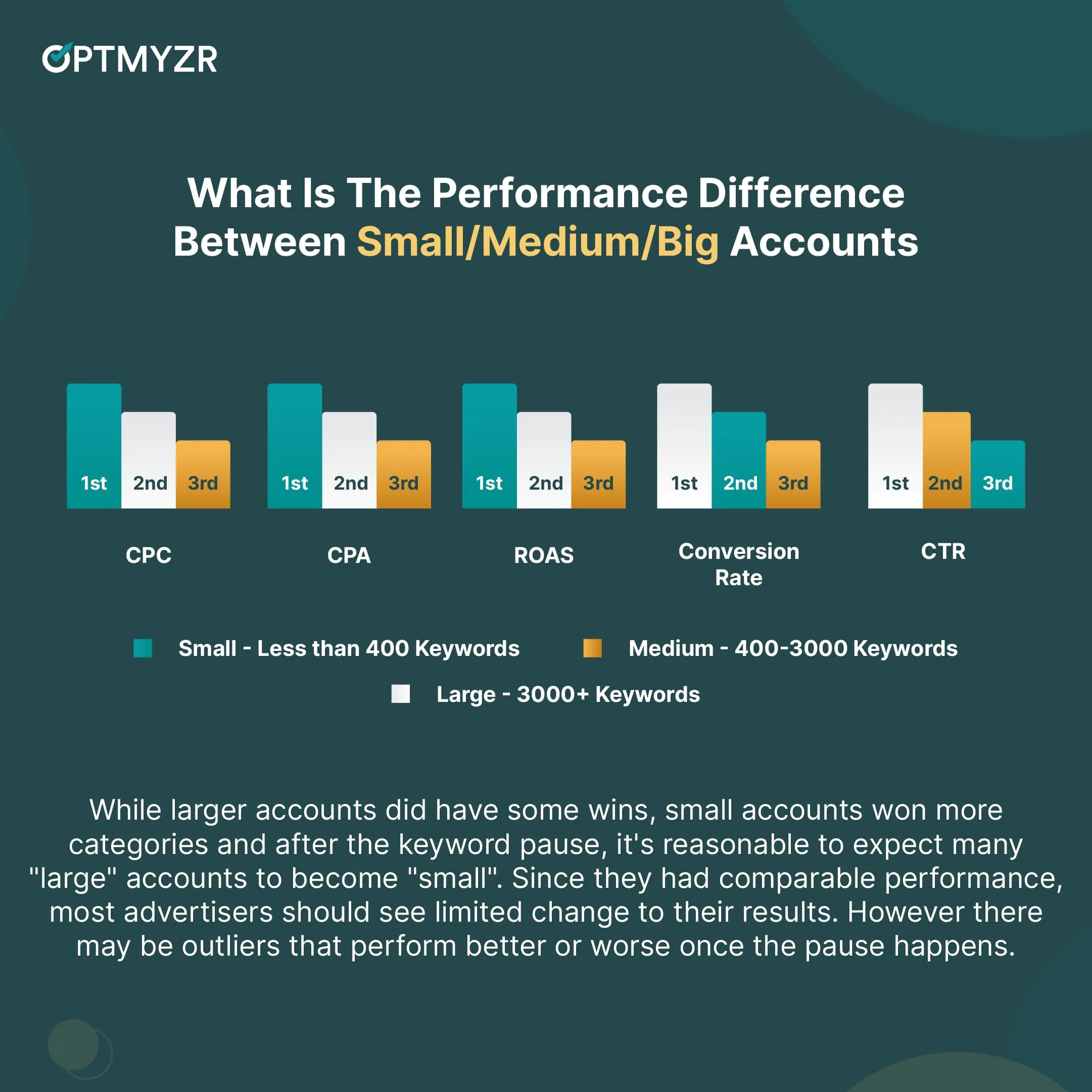

How Many Accounts Are Small/Medium/Big, And Is There Any Meaningful Performance Difference Between These Accounts?

Small: 4300 total accounts: Won on CPC, CPA, and ROAS

Medium: 3623 total accounts: No Winners

Large: 1507 total accounts: Won on Conversion Rate and CTR

While larger accounts did have some wins, small accounts won more categories and after the keyword pause, it’s reasonable to expect many “large” accounts to become “small”. Since they had comparable performance, most advertisers should see limited change to their results. However there may be outliers that perform better or worse once the pause happens.

Are There Any Accounts At Risk For Performance Loss

Low/No Risk: 4904

High Risk: 145

Unknown Risk:4381

While there are some accounts that have reason to be concerned (they had some of the best performance of the entire cohort of ad accounts), they also represent such a small percentage of the overall sample size.

The majority of accounts show no risk or unknown risk. Here’s why:

- Smaller accounts (under 400 keywords) had the best ROAS, CPAs, and CPCs. This was true regardless of whether they had a lot of low volume keywords. Most accounts should fall into this category after the initial pause.

- ROAS was strongest in accounts with higher percentages of low volume keywords. However it’s unclear whether this is a correlation or causation. We’ll have more insight when we run the numbers again post the pause.

- Medium accounts (400-3000 keywords) had the worst performance of any cohort, and represented the second largest cohort of advertisers. These brands should see no change or potentially an improvement to their ad accounts.

- Large accounts (3000+) seemed to have the strongest overall performance, however they also benefited from being older accounts. Note, this is an educated guess based on SKAG structure being an older account type from the pre-close variant era.

As we mentioned in the beginning, we acknowledge that there’s some concern around performance loss, but there is no concrete data to say one way or the other.

What Should You Do Regarding The Big Pause

We were surprised at how many accounts would be impacted by this update, and were relieved that there aren’t any major risk signs in the forecasting data.

If you’re an Optmyzr customer, you can use Rule Engine to bubble up zero impression keywords in your account so you can review them before they get to the 13 month threshold.

Typically when a keyword is getting zero impressions, it means one of these things:

- The bid isn’t high enough.

- The keyword is in the wrong ad group/campaign.

The Bid Isn’t High Enough

No keyword will be able to overcome a bidding problem. If a keyword’s auction price is $5-$10 and you’re bidding $2.50, there’s no way you’ll be able to rank for any meaningful queries.

This is where impression share lost to rank comes in. Impression share lost to rank tells you what percentage of available impressions you could be getting (but aren’t) due to low ad rank. While it’s reasonable to have some impression share lost to rank, anything over 10% is a sign that your structure and bidding are not aligned.

Additionally, you should consider your bidding strategy and any bid caps. If a budget is too low to meet a given conversion goal (volume or value), you will force yourself to underbid (even if you don’t provide a bid cap/floor).

Make sure that your budget can support at least 10 clicks per day (especially for non-branded search). If you don’t budget for at least 10 clicks, you’re banking on a better than 10% conversion rate. Search budgets should be able to deliver at least one conversion per day on paper, otherwise your budget is going to be wasted due to under budgeting.

Google is not going to be able to allocate budget in a meaningful way. Either it will double your daily spend to try and get you a few useful clicks knows it - which is why you might be forced to under bid and miss out on valuable impressions, clicks, and conversions.

The Keyword Is In The Wrong Ad Group/Campaign

Nothing is more tragic than a valuable keyword missing out on budget because it didn’t win initial auctions. When you put a campaign on Smart Bidding, you’re asking it to put budget behind entities that will drive conversions or conversion value. If there are too many entities sharing the same budget, it’s very easy for worthy keywords/ad groups to get passed over.

Previous data has shown that exceeding 10 ad groups per campaign can cause budget allocation issues. If your campaign has 15+ ad groups, it’s going to be hard to fuel all your keyword concepts. Consider moving zero impression keywords that aren’t covered by performing keywords to a different campaign. Where possible, pause redundancies (which is what’s happening June 11th).

PPC and Google Ads Experts Weigh In

We were lucky enough to get Friends of Optmyzr to share their perspective on the data. Here are some of their takes:

“The majority benefit from new structure”

The study echoes what I have found in audits, that pausing zero impression keywords likely doesn’t negatively affect performance and in the case of the small accounts I work with, has a negligible or positive impact. The majority of low impression keywords I see would benefit from a new structure if they’re important to the advertiser which is also echoed in the study. I’m excited for part two!

Amalia Fowler, Owner, Good AF Consulting

“Blurs the lines between ad platform and ad partner”

I think this change continues to blur the lines between Google as the advertising platform and Google as an advertising partner, which troubles me. In the former, a platform would not bother itself with something as simple as account organization. Whether to pause or keep keywords live that really have no impact on an account is, at its core, an organizational decision… which should, in my opinion, be left to the advertiser or advertising partner.

The Optmyzr study demonstrates exactly this: while many accounts are impacted, it really has no impact on the accounts. Admittedly, one could come away with the conclusion, “what does it matter if Google pauses these keywords automatically? It’s not really a big deal.” They would be right from a practical perspective, there would be no measurable difference in the vast majority of accounts.

However my concern with these types of things is that Google continues to make more changes and policies that blur the lines between platform and ad partner (which is partially responsible for their antitrust lawsuits, in my opinion, since they exercise freedom such as this in platform decisions that a non-monopolist company would not be able to engage in without losing customers).

All that to say, I think, philosophically, Google should leave organizational decisions like this to account managers.

Kirk Williams, Owner, ZATO

“No malicious intent… but how will it make Google more money?”

When I see a product change announcement like this, I always ask myself two things:

1. How does this make Google more money?

2. How can I ensure it makes me/my client more money, too?

Pausing low volume keywords seems innocuous, and I’m glad this study shows that for most advertisers, it will be.

But Google wouldn’t go through all this effort, communication, skepticism, etc. without something to gain. No malicious intent inferred here, just acknowledging that Google is a for-profit business.

So how will this make Google more money? My hypothesis is increased broad match adoption and/or PMax adoption when accounts have fewer keywords in them.

Jyll Saskin Gales, Google Ads Consultant, Learn With Jyll

“Step back from reacting and trust the data”

The Optmyzr study on pausing low-activity keywords is a great example of why data is important. While the initial announcement caused a stir in the industry, these results suggest minimal disruption for most accounts. This had been my initial guess as well.

This study really highlights the importance of stepping back from reaction and trusting data.

Sure, skepticism towards Google’s changes is healthy, but when the data shows potential benefits, like potentially aligning with simpler structures that the algorithm might favor, we as advertisers need to be adaptable.

The study’s finding on smaller accounts performing well also reinforces this idea of efficiency with less complexity. (this wasn’t an explicit finding however).

Sarah Stemen, Owner, Sarah Stemen LLC

Should I Re-Enable Paused Keywords?

Short answer: It depends.

Long answer: Likely not, but here’s an important checklist to run through if you’re considering it!

- Is the keyword something I have active because my boss/client told me to?

- If Yes: create the keyword in a new campaign focused on those client/boss asks that doesn’t have performance goals attached to it.

- If No: test leaving it paused if existing keywords cover it, otherwise consider moving it to a new campaign.

- Am I consistently losing more than 50% impression share due to rank?

- If Yes: you likely have a budget/structure problem and will need to make some choices around using search to go after that part of your business.

- If No: leave paused.

- Were there any major events that might have caused performance glitches?

- If Yes: re-enable, and consider passing that info into the data center.

- If No: leave paused

If you’re not an Optmyzr customer, the best way to check for these paused keywords is the change history. You’ll be able to review the paused keywords and re-enable them. However if they don’t get any impressions after 90 days, they will be re-paused. This is why we suggest thinking critically if the keyword is in the best spot in the account.

If you are an Optmyzr customer, we will echo the earlier recommendation to use the Rule Engine to keep you up to date, as well as the quick insights on the dashboard to check your ratio of low volume keywords.

You can sign up for a free trial here.